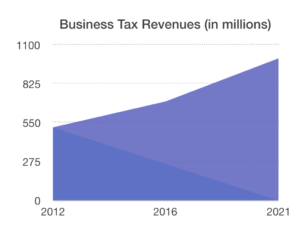

New Hampshire’s booming economy continues to fill state coffers with excess cash drawn from business taxation, with impressive numbers posted each month. But a longer look back illustrates the stunning sums businesses have contributed to the state budget in the past decade.

From Fiscal Year 2012 through Fiscal Year 2021, business tax revenues exceeded budget projections by $649.6 million — or 100.1 percentage points.

That is, over that time businesses gave legislators an additional $649.6 million to spend beyond what lawmakers had budgeted.

Imagine if, over a decade, your largest source of income came in at double what you had budgeted for it. That’s what happened to state business tax revenues from FY 2012-2021.

State Fiscal Year 2022 began last July, and so far the trend continues.

Since the start of the fiscal year in July, business tax revenues are $109.5 million (27.9%) above the prior fiscal year and $72.7 million (16.9%) above budget.

Add this to the total from FY 2012-2021, and business tax revenues have come in over budget by $722.3 million since FY 2012.

To get an idea of just how much larger state business tax revenues are today, consider that in FY 2012, Business Profits Tax revenue from July-December totaled $140.5 million.

Adjusted for inflation, that $140.5 million would be approximately $166 million in 2021.

Actual BPT revenues for July-December of 2021, however, were a record $381.2 million — 240.7 million (171%) higher than in 2012.

Combined BPT and BET revenues in the first six months of FY 2012 were $231.7 million.

In the first six months of FY 2022, they were $501.8 million, a 216.5% increase.

The historical context shows that state is playing with house money, so to speak, when it comes to business tax revenues. It shows further that additional small reductions to business tax rates are not only affordable, but fully justified.

The state has taken in nearly 3/4 of a billion dollars in unanticipated business tax revenue since 2012. Claims that tiny rate reductions will bankrupt the state or devastate essential services are laughably unfounded.

Business tax rate reductions that began in the 2016 fiscal year did not cause business tax revenue to fall below previous levels, as critics had predicted. Then-Gov. Maggie Hassan said the rate cuts would reduce business tax revenue by $90 million. Instead, business tax revenues were $132.8 million (23.4%) above plan in FY 2016.

From FY 2012-2021, business tax revenues came in below budget for the year only twice: in 2014 (before the start of the business tax cuts) and in 2020 (when businesses were hit by the pandemic). The huge gains in other years more than made up for those relatively small declines (2% and 13%, respectively).

Businesses in New Hampshire have fed the state budget astonishing sums over the last decade. Yet every time anyone suggests slight reductions in corporate tax rates, advocates of higher taxes attack businesses as greedy, selfish, avaricious, even unpatriotic.

In truth, New Hampshire employers have enabled the state’s ever-growing social welfare spending, and most have remained in New Hampshire despite the lure of lower corporate tax rates in other states. They should be thanked for their contributions, not vilified. Adjusting their rates to let them keep a little more of their income would be a reasonable way to say thank you.