After months of unsuccessfully pushing the $5 trillion ‘Build Back Better’ plan, President Joe Biden and the White House cut its size and gave it a new name: The “Inflation Reduction Act.” (IRA). It was enough to get the support of every Democrat in Congress, including the recalcitrant West Virginian, Sen. Joe Manchin.

All four of New Hampshire’s congressional Democrats were vocal supporters of the bill, too.

But now Biden has admitted the law “has nothing to do with inflation,” and the latest numbers show the Biden administration is on course to add $2 trillion to the national debt this fiscal year alone.

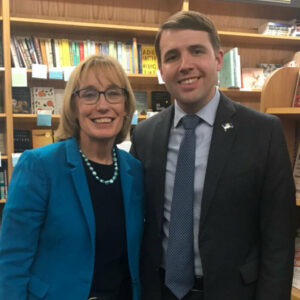

With that new information, do self-declared moderate Democrats like Sen. Maggie Hassan and Rep. Chris Pappas regret their votes that helped pass the IRA?

No comment.

It was hardly a surprise the act didn’t live up to its name. The name resulted from a desperate play by Senate Democrats and the White House to get Manchin and Sen. Kyrsten Sinema (D-Ariz.) on board for a massive spending proposal. (Sinema has since changed her party affiliation to “independent.”)

At the time, critics — and even many supporters — admitted the bill would not reduce inflation. As the leftwing website Slate.com said at the time, the bill was “too small to affect inflation meaningfully one way or another. But beneath the bill’s poll-tested title is a permanent tax policy to promote broad clean energy programs for the first time, ever.”

Nearly $400 billion in new spending for green technology, plus more spending on healthcare and some tax increases. Even partisan news outlet NPR declined to call the bill by its less-than-accurate name, instead labeling it “a bill to address climate change, taxes, health care, and inflation.”

Last week during a fundraising swing through three western states, Biden admitted he was in on the joke.

“The Inflation Reduction Act — I wish I hadn’t called it that because it has less to do with reducing inflation than it does to do with dealing with providing for alternatives that generate economic growth,” Biden said in Park City, Utah.

And at a fundraiser in New Mexico earlier in the week, Biden was even more direct.

“It has nothing to do with inflation. It has to do with the $368 billion, the single-largest investment in climate change anywhere in the world, anywhere. No one has ever, ever spent that.”

It is true that the surge in prices under Biden, hitting an annual rate of 9.1 percent not seen in 40 years, has subsided — though last month’s 3.2 percent rate is both higher than a month earlier and more than twice the inflation rate Biden inherited when he took office. Economists say the IRA played no role in slowing inflation down.

“I can’t think of any mechanism by which it would have brought down inflation to date,” said Harvard University economist and former Obama advisor Jason Furman.

And Alex Arnon, an economic and budget analyst for the University of Pennsylvania’s Penn Wharton Budget Model, told Fortune, “We can say with pretty strong confidence that it was mostly other factors that have brought inflation down. The IRA has just not been a significant factor.”

Meanwhile, prices are still rising, just not as fast. The typical American household spent $709 more in July than they did two years ago to buy the same goods and services, according to a new report from Moody’s Analytics.

All this Washington spending has to be paid for, and D.C. has been driving up the national debt to do it.

Taxpayers borrowed $221 billion in July alone, taking this fiscal year’s deficit up to $1.6 trillion. If August and September hit similar numbers, America will have added $2 trillion to the deficit in a single year — in part to pay for the IRA.

At $1.6 trillion, or $5.3 billion per day, the deficit for the first 10 months of the fiscal year is more than we borrowed in all of 2022,” Maya MacGuineas, president of the Committee for a Responsible Federal Budget, said in a statement. “Unfortunately, our borrowing will only increase further until we finally decide that enough is enough.”

And, MacGuineas added, the recent downgrade of U.S. debt by Fitch Ratings “should jolt policymakers awake. Regardless of one’s opinion on the timing, the core concerns about our fiscal situation are undeniable. We are watching deficits climb, debt soar, and the Social Security and Medicare trust funds near exhaustion.”

Not surprisingly, Republicans point the finger at Democrats like Pappas.

“Thanks to Bidenomics and his enablers in Congress like Chris Pappas, Americans are in more debt, struggling to put food on the table and unable to save for emergencies. The state of Bidenomics is weak,” said National Republican Congressional Committee spokeswoman Savannah Viar.

So, are the Granite States’ representatives in Washington, D.C., worried about the rising debt? Are they bothered by their role in what critics see as a bait-and-switch on the so-called Inflation Reduction Act?

NHJournal reached out repeatedly to all four members of the delegation to ask. All four were unwilling to answer the questions.