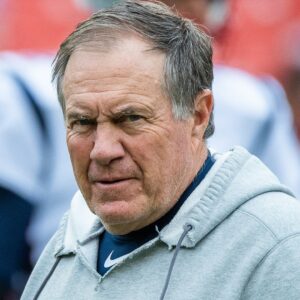

Massachusetts’ millionaires tax makes it harder for the New England Patriots to recruit top players, former Patriots coach Bill Belichick said on Monday.

Asked about the millionaires tax on The Pat McAfee show, Belichick said, “That’s Taxachusetts. They take more from you.”

Because the NFL’s high pay makes most players millionaires these days, the tax implications of playing in Massachusetts are factored into player contract talks, the Patriots legend said.

“Virtually every player, even the practice squad, even the minimum players are pretty close to $1 million,” he said. “Once you hit the $1 million threshold, you pay more state tax in Massachusetts. Just another thing you’ve got to contend with in negotiations up there. It’s not like Tennessee or Florida or Nevada. Some of these teams have no state income tax. You get hit pretty hard on that with the agents.”

How many people can name any of the handful of states that have no income tax? Belichick quickly rattled off the names of three without even thinking about it.

If NFL players, coaches and agents think enough about high taxes to know which states have no income tax, what about other high earners?

For the second year in a row, the Massachusetts Society of Certified Public Accountants has issued a report warning the millionaires tax is driving high-income professionals out of the state.

“The survey results indicate a concerning trend: a significant number of high-income individuals and businesses are considering or have already relocated out of Massachusetts,” according to the report. “This outmigration coincides with the surge in the number of taxpayers impacted by the surtax.”

More specifically:

“Every individual surveyed said that overall tax policy in the Commonwealth was either the primary reason clients are moving or one of the reasons that clients are considering moving. 55 percent of those surveyed earlier this year indicated that tax policy was the primary reason for relocating. Nearly everyone surveyed stated that the millionaires tax specifically factored into their client’s decision to relocate, with 64 percent stating that the tax was one of the reasons that their client is considering moving their domicile and 34 percent indicating that the tax was the primary reason for relocating.

‘Two-thirds of those surveyed reported that at least one of their clients has already established their domicile away from Massachusetts within the last 12 months. Many high-income residents are seriously considering changing their domicile, with 90 percent of respondents indicating that their high-income clients are considering moving from Massachusetts in the next year. This has increased by 8 percent in just one calendar year, from 82 percent of individuals surveyed in 2023.”

The top states Massachusetts millionaires say they’re eyeing? New Hampshire, Florida and Texas. (Two of the three have NFL teams, by the way. All three have no income tax.)

“Fifty-three percent of accounting professionals say that their clients are considering moving across the border to New Hampshire, suggesting that the tax burden imposed by Massachusetts plays an important part in the decision to relocate — and refuting the claims that individuals are just relocating due to a desire for sunnier weather and more coastline,” according to the CPAs’ report.

High taxes don’t send only millionaires packing. For years, the Tax Foundation has documented the moving habits of Americans and found there’s a consistent trend of people moving from high-tax to lower-tax states. This year’s report showed average Americans continue to flee high-tax states for lower-tax ones.

“The U.S. population grew 0.49 percent between July 2022 and July 2023, an increase from the previous year’s 0.37 percent. While international migration contributed to population growth at the national level, interstate migration was the key driver of net population changes at the state level. The U.S. Census Bureau’s most recent interstate migration estimates show that New York lost the greatest share of its population (1.1 percent) to other states between July 2022 and July 2023. Not far behind was California, which lost 0.9 percent of its residents, followed by Hawaii (0.8 percent), Alaska (also 0.8 percent), and Illinois (0.7 percent). At the other end of the spectrum, South Carolina saw the greatest population growth from net domestic inbound migration (1.6 percent), followed by Delaware(1.0 percent) and North Carolina, Tennessee, and Florida (all 0.9 percent).

“This population shift paints a clear picture: Americans are leaving high-tax, high-cost-of-living states in favor of lower-tax, lower-cost alternatives. Of the 32 states whose overall state and local tax burdens per capita were below the national average in 2022, 24 experienced net inbound migration in FY 2023. Meanwhile, of the 18 states and D.C. with tax burdens per capita at or above the national average, 14 of those jurisdictions experienced net outbound migration.

“Though only one component of overall tax burdens, the individual income tax is particularly illustrative here. In the top third of states for population growth attributable to domestic migration, the average combined top marginal state income tax rate is about 3.8 percent. In the bottom third (including D.C.), it’s 3.5 percentage points higher, at about 7.3 percent.”

Supporters of Massachusetts’ millionaires tax boast that it brought in far more revenue than predicted. This means that it’s a net gain for the state, they say. Given that 53 percent of Massachusetts accounting professionals said their wealthiest clients are considering moving to New Hampshire for its low taxes, it would be to New Hampshire’s short-term advantage for Bay State politicians to continue thinking that this punitive 9 percent income tax is good for their state. When wealthy people move here to escape high taxes, they tend to vote to keep New Hampshire’s taxes low. They also invest in their new home state, give to its charities and otherwise participate in its economic and civic life.

But in the long run, this misguided tax will hurt New Hampshire too if it slows down the Massachusetts economy. We do better when our neighbors do better. Ultimately, all of New England would benefit were Massachusetts (as well as all of our other high-tax neighbors) to pursue a competitive rather than a punitive tax policy.