Van Ostern Firm Fined, Sanctioned for Misleading Investors

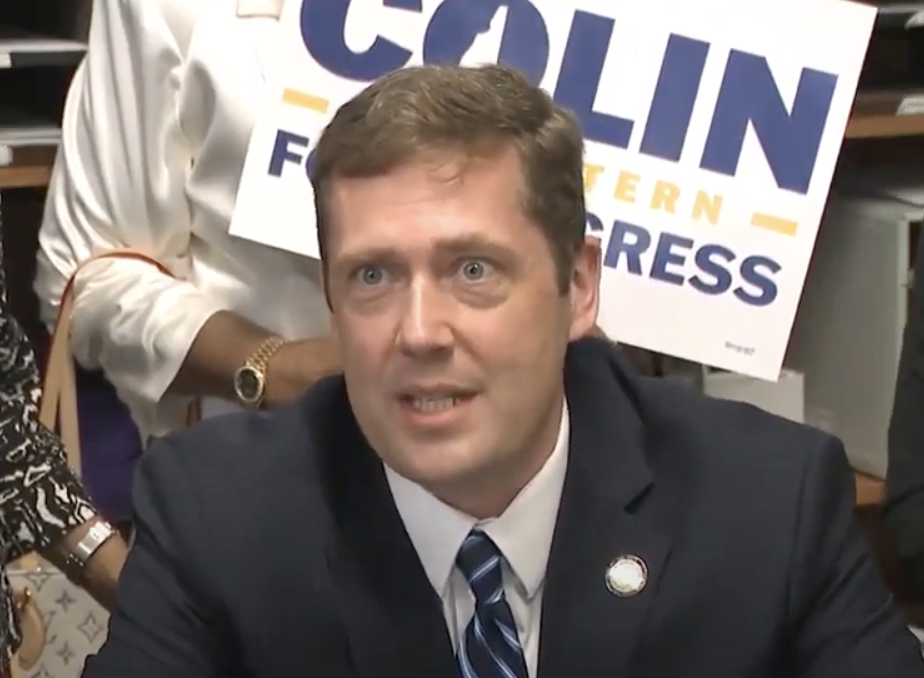

As Rep. Annie Kuster’s handpicked successor, Democrat Colin Van Ostern wants voters to forget the time his financial firm was paid millions for misleading its investors.

Van Ostern was president and chief operating officer at Manchester-based Alumni Ventures from 2019 through 2023, a position he left to launch his current campaign. In 2022, federal and state regulators investigated the company, finding it lied to customers and improperly moved millions between accounts.

Van Ostern did not respond to a request for comment.

In 2022, Alumni Ventures agreed to pay back more than $4.7 million to investors taken in an allegedly misleading fee schedule. The company also paid millions to regulators in New Hampshire and Massachusetts, as well as fines to the Securities and Exchange Commission.

According to documents, the company misled investors by telling them the fee to manage investment funds would be “the industry standard of 2 and 20.” That’s generally understood to mean a two percent management fee every year for 10 years, and a 20 percent share in the eventual investment profits.

But that’s not what Alumni Ventures charged. Instead, the company took 10 years worth of two percent fees, or 20 percent, off the top of all investments. If a customer gave the company $100,000 to invest, Alumni Ventures would immediately take $20,000, leaving less money for the investment, according to the records. That money was then used to fund the business.

“This practice amounted to an undisclosed interest-free loan to [Alumni Ventures] from the funds it managed,” New Hampshire’s Bureau of Securities Regulation statement makes clear.

Van Ostern’s firm was also sanctioned for allegedly moving around investment fund money, effectively giving itself interest-free loans, according to the Massachusetts court order.

“The loans from [Alumni Ventures] to the Funds had no predetermined maturity date or interest rate, and their timing and repayment amount was solely in [Alumni Ventures’] discretion. The loans were not memorialized in a written debt instrument at the time the loans were made, and were not disclosed to investors,” the Massachusetts order states.

Alumni Ventures ended up paying a $700,000 fine to the SEC, and founder and CEO Michael Collins paid a $100,000 penalty to the federal agency. The company was ordered to pay $750,000 in fines and administrative costs in Massachusetts. New Hampshire regulators assessed a $600,000 fine, $100,000 for the investigation, and another $100,000 fine from Collins.

The company was also ordered to change its marketing material to inform potential customers about the real fee schedule.

The questionable conduct regulators targeted occurred between 2016 and 2020, according to the records, ending about a year after Van Ostern became COO. The Alumni Ventures job is one of many private sector positions Van Ostern occupied after he lost the 2016 gubernatorial race to Gov. Chris Sununu.

Van Ostern has long been a player in New Hampshire politics, though mostly assigned to the bench. After earning an MBA at the Tuck School of Business at Dartmouth College, Van Ostern worked as Democratic Gov. John Lynch’s majordomo as well as operating a consulting firm. His early clients were Sen. Jeanne Shaheen and Kuster.

Van Ostern was elected to the Executive Council in 2012 and served alongside Sununu until they faced off in the 2016 governor’s race.

Van Ostern also tried, and failed, to unseat Secretary of State Bill Gardner in 2018 before moving into the private sector. He did stints at yogurt maker Stonyfield and Southern New Hampshire University before landing at Alumni Ventures.

Collins started the Manchester-based Alumni Ventures in 2014 as a venture capital investment firm. The company has raised more than $1 billion in funds since it started.