We’re living in a “buy now, pay later” society, and unfortunately, our government has adopted the same mentality.

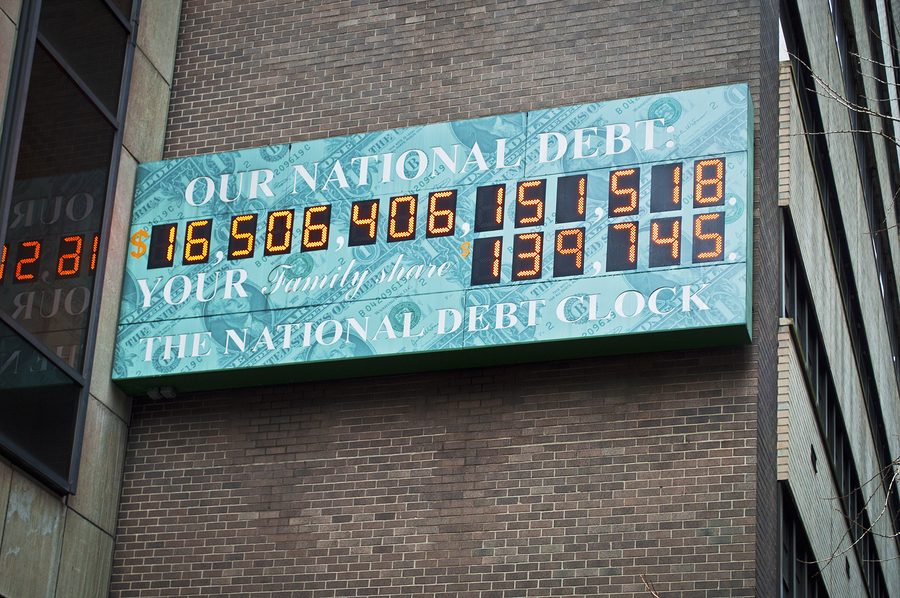

The U.S.’s publicly held national debt has ballooned to a staggering $28 trillion, nearly equal to the entire annual output of the U.S. economy. This isn’t just an economic statistic; it’s a reflection of our national character, a willingness to indulge in short-term gratification while passing the buck to future generations.

We’ve become addicted to debt, financing our present comforts at the expense of our children’s future. This isn’t just a matter of fiscal irresponsibility; it’s a question of intergenerational equity. Do we have the right to burden our children and grandchildren with the cost of our own excesses?

The consequences of this fiscal irresponsibility are far-reaching and impact every facet of American life. Slower economic growth, higher interest rates, and a reduced ability to respond to emergencies are just some of the direct impacts of our growing debt burden. Imagine the opportunities lost when, instead of funding education or our crumbling infrastructure, we spend $892 billion on interest payments alone, as we did in 2024.

While our geopolitical rivals are investing in the latest cybertechnology and AI capabilities, we are diverting resources just to service the debt we have so ravenously created.

Think of the talented students who can’t afford college, the businesses that can’t expand due to high borrowing costs, and the families struggling to make ends meet as inflation erodes their purchasing power. A high national debt acts as a drag on the economy, limiting our potential and diminishing our quality of life.

Some argue that we can inflate our way out of debt or simply rely on economic growth to magically erase our financial obligations. But these are dangerous fantasies. Inflating our way out of debt would lead to hyperinflation, eroding the value of savings and destabilizing the economy. And while economic growth is essential, it’s unrealistic to expect it to solve the problem on its own. We can’t simply grow our way out of this hole, we need to change our spending habits. We need to learn to live within our means, just as families and businesses must do.

The truth is there’s no pain-free solution. Addressing this crisis will require tough choices and a commitment to fiscal responsibility from both our leaders and ourselves. We need to demand more from our elected officials, holding them accountable for their spending decisions and insisting on a long-term plan for debt reduction. We need to elect leaders who prioritize fiscal responsibility and who are willing to make the difficult choices necessary to secure our economic future.

We need a comprehensive approach that includes both spending cuts and revenue increases. We need to reform entitlement programs, control healthcare costs, and make smart investments in our future. This isn’t about austerity; it’s about prioritizing long-term sustainability over short-term political gain. It’s about making the difficult choices today to ensure a brighter future for tomorrow. It’s about ensuring that our children inherit a country that is strong, prosperous, and full of opportunity.

The longer we wait, the more painful the consequences will be. It’s time for a national conversation about our priorities and how we’re going to pay for them. It’s time to demand that our leaders show fiscal responsibility and put the U.S. on a sustainable path.

It’s time to stop digging our way to economic ruin and return to the basic principle that if something is worth doing, it’s worth paying for.