Intended to be primarily a state-run program, the Biden administration is attempting to expand its power over the management of Medicaid.

The Centers for Medicare & Medicaid Services (CMS) is reviving the Medicaid Fiscal Accountability Rule (MFAR) regulating how Medicaid funds are handled and putting at risk matching federal dollars for states like New Hampshire.

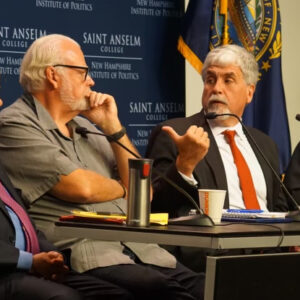

The proposed rule was the topic of an Inside Sources/NHJournal Roundtable featuring state Senate President Jeb Bradley (R-Wolfeboro), former U.S. Department of Health and Human Services Deputy Secretary Eric Hargan, and N.H.-based Republican strategist David Carney.

Originally proposed in 2019, the goal of MFAR was to contain costs and make state Medicaid payment programs more transparent.

In practice, however, MFAR would have given CMS significant authority over states’ Medicaid financing plans. According to Hargan, MFAR “gave a lot of discretion to the agency and to the staff at the agency to decide…whether or not a state’s financing proposal was acceptable to them or not.”

The rule also would have cut upwards of $50 billion in federal Medicaid funds.

As a result, MFAR faced serious bipartisan opposition, and President Donald Trump ordered CMS to withdraw the rule in January 2021.

“When the Rev. Al Sharpton and [Texas] Gov. Greg Abbott are on the same side opposing something, you know it’s unpopular,” Carney noted during the roundtable.

Senate President Jeb Bradley (far left) takes a question from the audience at a Medicaid funding roundtable hosted by InsideSources/NHJournal. Also participating are GOP consultant Dave Carney, former HHS official Eric Hargan, and moderator Michael Graham (far right) of NHJournal.

But now it is back. Despite both President Joe Biden and Vice President Kamala Harris campaigning against MFAR in 2020, a re-packaged version of the rule has emerged from Biden’s CMS. The courts have routinely blocked those updated proposals, but the new rules now rely on a novel interpretation of the “hold harmless” prohibition.

Under federal Medicaid law, it is illegal for a state government to impose a tax on healthcare providers and then hold those taxpayers harmless for any portion of the tax costs by transferring dollars back to them.

But while the state cannot move Medicaid dollars in that way, it has been generally understood that private entities can transfer money. “For example, the Missouri Hospital Association gets money every year,” Hargan said. “They then reapportion the money – some of the wealthier hospitals end up transferring money to smaller, rural hospitals, by and large, to keep them open.”

Hold harmless arrangements are illegal if the state is involved. So, is the state involved if private entities reapportion money between themselves in a way similar to Hargan’s example? Apparently so, according to CMS.

“The agency now says, even if it’s two private hospitals, the state knows nothing about it, they’re transferring money, and it’s not legally enforceable… that’s a hold harmless,” Hargan added. “And that means that the state’s Medicaid proposal can be criticized, reduced, bounced back, [and] made to be redone.”

Although courts have also put that rule on hold, states that have challenged that CMS is now auditing authority. If the proposed rule goes forward, the auditing power would expand along with it.

And, Hargan noted, the language of the rule gives the agency the power to review how money is transferred “in the totality of the circumstances,” which means there is no limiting principle.

For example, because rural hospitals in New Hampshire especially count on Medicaid funding, the state has a Disproportionate Share Hospitals (DSH) agreement where, according to Bradley, “The money is not delivered equally on a per-patient basis but based more on need, and so smaller, more rural hospitals tend to do a little bit better.”

Would that pass muster under a review? The agency would decide.

And what is the impact if the DSH money is restricted? “That would be devastating for New Hampshire,” Bradley said.

Additionally, if big, urban hospitals are prohibited from helping small, rural hospitals, one of two outcomes would likely result: Closure or consolidation. Either the small hospitals would close, or the big hospitals would buy the small ones and transfer the money within their system, which would be permitted under the CMS rule.

“They can just cycle the money inside their system, and so it’s a pressure towards consolidating systems across all of these smaller communities,” Hargan said. “This just adds impetus to it, either to close or to consolidate.”

And who does this hurt most?

“You’re talking about shutting down access to the underserved in urban areas and to the underserved in rural areas, and we’ll basically have suburban hospitals and the big, major Mass General hospitals,” Carney said. Granite Staters would potentially lose local hospitals like Littleton Regional and Monadnock Community Hospital, forcing many to travel much farther to larger hospitals like Dartmouth-Hitchcock Medical Center and Elliot Hospital.

Or these major hospitals would buy the smaller ones, as Concord Hospital did recently with its purchase of Lakes Region General and Franklin Regional Hospital.

This one-size-fits-all micromanagement by CMS is typical bureaucratic rulemaking, Hargan said. “It’s complicated for the federal government to manage 50+ different state Medicaid programs, so they (without saying it) prefer uniformity in these kinds of programs.

“And so the closer they get to something uniform, the happier they are as regulators in this space,” he added.

When all is said and done, the CMS rules could threaten New Hampshire’s tradition of local control and the benefits thereof. With the likely risks being closure or consolidation, that would mean less competition among hospitals in the state.

“Less competition among hospitals, I think, is problematic in many different ways,” Bradley responded during the roundtable. “Less competition generally tends to monopolize power and drive costs up.”