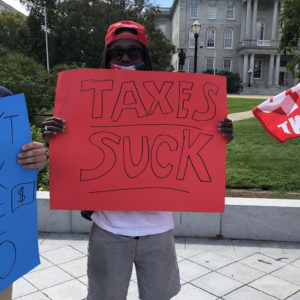

New Hampshire progressives are touting results from progressive pollsters showing voters support higher taxes on both businesses and individuals. Are they right?

While the two organizations behind the poll, Granite State Progress and Americans for Tax Fairness, are both on the far left, the pollsters are relatively well-respected firms who work with Democratic candidates.

The report, which can be found on the Granite State Progress, says 62 percent of New Hampshire voters support Biden’s proposals to raise taxes on those making over $400,000, and 64 percent want to increase the capital gains tax to the same rate as income taxes. Additionally, 56 percent support raising the corporate tax rate to 28 percent to pay for Biden’s proposed $4 trillion in spending.

“Our latest polling confirms that raising taxes on corporations and the wealthy is a top priority for Granite State voters, and they want to use that revenue to invest in our communities and to improve the lives of working families,” said Granite State Progress executive director Zandra Rice Hawkins. “Support for these issues is especially strong among New Hampshire’s unaffiliated voters, which is the state’s biggest voting bloc.”

Really? Is higher taxes on anyone a “top priority” for Granite Staters? If so, they have an odd way of showing it.

For example, the top two Democrats in the state, Sens. Jeanne Shaheen and Maggie Hassan, both embraced the New Hampshire Advantage as governors, refusing to support broad-based tax increases. It’s widely agreed that one of their keys to political success was their refusal to embrace an income or sales tax.

As for raising federal taxes, both are backing the new bipartisan infrastructure deal, which pointedly avoids any tax increases. According to media reports, not raising taxes –including taxes on the wealthy — was a non-negotiable part of the negotiations.

When former state senators Dan Feltes and Molly Kelly ran against Gov. Chris Sununu, they both went to great lengths to avoid being portrayed as pro-tax Democrats. Both pledged that, if elected, they would veto any income or sales tax.

A 2019 proposal to impose a state income tax on wealthy residents who earn more than the Social Security tax cap was so unpopular among Democrats that the Democrat-controlled Senate Finance Committee voted it down… then re-convened and voted it down again just to be safe.

Gov. Chris Sununu and the Republican legislature have been touting their tax cuts in the new budget — including eliminating the state’s tax on interest and dividend taxes — for nearly two months, and Sununu’s poll numbers remain high.

So perhaps the Democratic pollsters and progressive activists are correct, and New Hampshire voters are very excited about tax hikes. The numbers are the numbers.

But if the progressives are right, why is it so hard to find any New Hampshire Democrats supporting these tax hikes? Why isn’t Hassan, likely facing a tough reelection campaign next year, holding press conferences calling for higher taxes from Berlin to Bedford?

Or, to put it another way, is there anything Sununu would like more than to run against “Higher Taxes Hassan” next year?

The response from New Hampshire Republicans to this new poll is essentially, “Higher taxes are great! Democrats — you go first.”

“I’m concerned that NH Senate Democrats are looking to DC for inspiration on tax policy,” said Senate President Chuck Morse (R-Salem). “Are they so tone deaf they can’t understand that hardworking New Hampshire families and small businesses do not want more taxes?

“It’s no surprise that New Hampshire Senate Democrats opposed the frugal, conservative state budget that cut taxes for everyone and addressed our state’s needs and priorities without a sales or income tax. The Democrats’ unquenchable thirst to spend money, raise taxes, and create more government is causing prices to skyrocket on everything from food to gas and put our economy on the brink of crippling inflation.”