Is the job of a retirement fund investor to help you maximize your investments to fund your retirement, or to make “socially responsible” investments with your savings?

Until the Biden administration changed the rule, federal law required the former. This week, all four Democrats in the New Hampshire federal delegation voted for the latter.

At issue is a rule change Biden’s Department of Labor slipped through over Thanksgiving week last year ending the federal mandate that retirement plan sponsors make investment decisions based on fiduciary concerns — maximizing the wealth of retirees. Under the 1974 Employee Retirement Income Security Act (ERISA), managers handling approximately $12 trillion on behalf of 150 million Americans, were instructed to make decisions “solely in the interest” of participants and beneficiaries.

Not anymore. Biden’s rule allows them to invest based on environmental, social, and governance (ESG) factors.

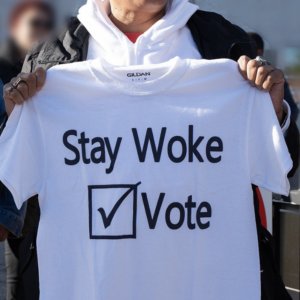

Supporters of so-called ‘woke’ investing say keeping retirement funds away from investments in fossil fuels, military contractors, gun manufacturers, etc. can be a winning investment strategy. Opponents, like New Hampshire Attorney General John Formella, say retirement security is too important. He’s one of 25 state attorneys general suing the Biden administration to stop the rule change.

“Federal law has long required fiduciaries to place their client’s financial interests at the forefront, and that is something that should not change,” Formella told NHJournal during a recent podcast interview.

New Hampshire’s top Democrats don’t agree. On Tuesday, a bipartisan majority in the House passed a resolution opposing the rule change, 216-204. Both Reps. Annie Kuster and Chris Pappas were part of the all-Democrat minority.

On Wednesday, the resolution came before the U.S. Senate. Once again there was a bipartisan vote (5-46) rejecting the rule change. But both Sens. Maggie Hassan and Jeanne Shaheen stuck with the partisan minority.

President Biden is expected to veto the resolution, leaving retirement fund managers free to use their political views as part of their portfolio management. And, of course, individual investors have always been free to put their own retirement savings into any investment they choose.

“This [resolution] simply says that the primary criterion has to be the financial return on investment,” said Sen. Mike Braun (R-Ind.) who sponsored the bill.

Democrat Sen. Jon Tester (D-Mont.) said he voted against the new Biden administration rule because it “undermines retirement accounts for working Montanans and is wrong for my state.”

All four members of the delegation refused to answer questions from NHJournal about their vote, or their view of retirees’ money being used for ESG investing without their knowledge.

Last year, Florida Gov. Ron DeSantis (R) proposed barring state pension funds from considering ESG factors when investing government money. “ESG provides a pretext for CEOs to use shareholder assets to target issues like reducing the use of fossil fuels and restricting Second Amendment rights,” DeSantis writes in his new book.

“The Administration is politicizing retirement savings and putting taxpayers and workers on the hook for the costs. No wonder it released the rule right before Thanksgiving,” The Wall Street Journal editorialized.