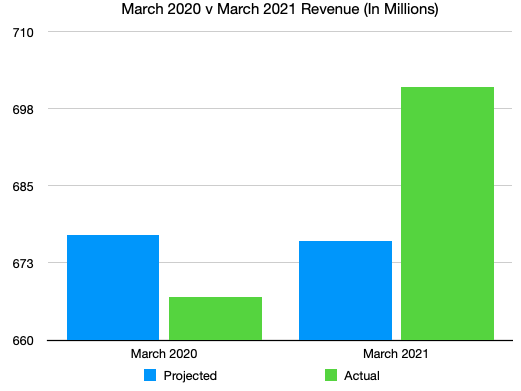

Gov. Chris Sununu and his GOP allies in the legislature pledged they could make tax relief part of the new budget, even amid the economic impacts of the COVID-19 pandemic. And the latest numbers from the Department of Revenue Administration are likely to make it easier for them to keep that promise.

The report released Monday was the latest data point showing that predictions of the Granite State’s economic demise were greatly exaggerated. Not only have revenues not collapsed, but the state will end the fiscal year in June with a surplus yet again.

In March alone, the state took in $701 million in revenue, 3.6 percent more than projected, which is $24.6 million more than anticipated. Nine months into the fiscal year, New Hampshire is up $181.5 million, or 9.6 percent over the previous fiscal year.

Senate President Chuck Morse, a Republican from Salem, called the numbers good news. “These March revenue numbers show that New Hampshire’s economy is roaring back,” Morse told NHJournal. “They show that we can give tax relief to our state’s small businesses as we’ve proposed and help lower local property taxes as we’ve promised.”

Greg Moore, New Hampshire State Director for Americans for Prosperity, said the new revenue figures prove the Granite State is ready for more tax relief.

“Today’s revenue numbers show that our state is continuing to rebound strongly coming out of the pandemic,” Moore said. “It also clearly demonstrates that there is a real opportunity to provide further tax relief that will help all employers continue to recover because while some industries thrived during this time, other industries, like restaurants and hotels, have had enormous setbacks and the last thing they need is a big tax bill.”

The legislature appears to be on the same page. The budget bills – House Bills 1 and 2, set for a vote Wednesday – contain a plethora of tax relief measures set forth by the House Finance Committee. The proposals include phasing out the asterisk on New Hampshire’s “no income tax” reputation: the Interest & Dividends tax.

Other tax relief measures include lowering the Business Enterprise and Business Profits Taxes, lowering the Meals & Rentals Tax as proposed by Sununu, and a one-time appropriation off-setting the Statewide Education Property Tax by $100 million.

One potential glitch: President Joe Biden’s $1.9 trillion spending plan includes a provision allowing the treasury secretary to review states’ tax cut policies. If Secretary Janet Yellen decides federal dollars helped make those tax cuts possible, she could punish the state in question by demanding a return of COVID-19 relief funds.

In response, a group of state attorneys general, including New Hampshire’s, is suing the Biden administration over that provision. Alabama’s Attorney General Steve Marshall called the “federal tax mandate is an unprecedented and unconstitutional assault on state sovereignty.”

State Senator Lou D’Allesandro (D-Manchester) said the March New Hampshire numbers are a welcome sight, but he rejects the argument that today’s economic growth is a signal to hold off on the more than $6 trillion in federal spending already passed or being proposed by congressional Democrats.

“Yes, New Hampshire’s numbers look good. Our real estate transfer tax has been out of the park,” D’Allesandro told NHJournal. “And deficit spending, as long as it produces the desired result, can create a moving economy. Our infrastructure has gone fallow for many years.”

On Wednesday the House is expected to vote on its version of the state budget, which House Majority Leader Jason Osborne said, “contains a treasure trove of tax cuts for NH businesses and taxpayers on a scale we haven’t seen in recent history.”