It’s the $34 trillion taxpayer elephant in the room that presidential candidates rarely talk about: America’s federal debt.

Which was why a group of fiscal hawks gathered in Manchester, N.H., days before the First in the Nation presidential primary to make it a topic of the political conversation.

“The truth is the U.S.S. America is taking on water,” said former U.S. Comptroller General David Walker. “And our superpower status is at risk.”

Walker was a panelist at the Debt, Deficit, and First in the Nation Primary roundtable, along with former U.S. Rep. Jeb Bradley, who now serves as New Hampshire state Senate president, and Joe Penland—aka “Joe From Texas”—a Lone Star State businessman behind a national effort to address the debt problem.

The panel was also joined by U.S. Sen. Joe Manchin (D-W. Va.), who was in New Hampshire as part of his “listening tour” promoting political compromise and bipartisan cooperation. Manchin echoed the message that America’s debt is a national danger, recounting his first Senate Armed Services Committee meeting in 2011.

Manchin recalled then-Chairman of the Joint Chiefs of Staff Michael Mullen being asked to name the country’s top threat.

“Mike Mullen, who has his finger on every part of the world and every hotspot that could be harmful to our country, never hesitated,” Manchin said. “He said the debt of the nation will take us down before any other military power does. The debt of our nation will take us down first.”

Federal debt at the time was $10.5 trillion— less than one-third of what it is today.

“I’ve seen it up close and personal for 14 years, and I’ve watched us accumulate debt at a more rapid rate than at any point in the history of our country,” Manchin added. “There’s no checks and balances.”

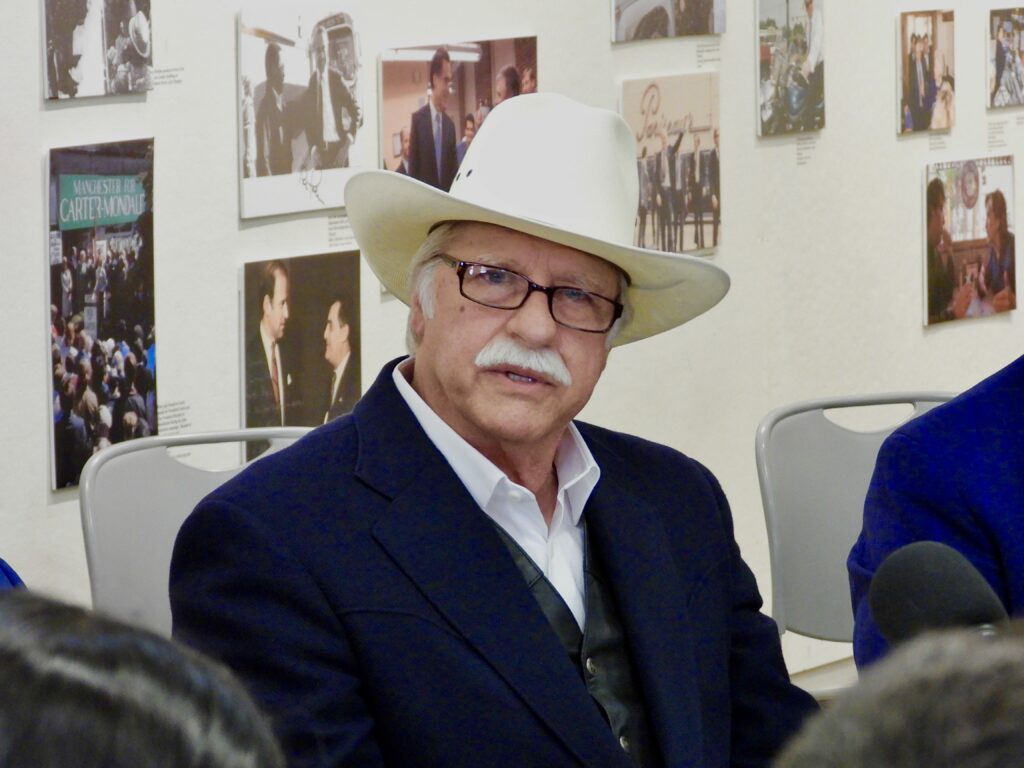

Joe “Joe From Texas” Penland, at the Debt and Deficit Roundtable in Manchester, NH on January 12, 2024

(CREDIT: Andrew Dow)

Penland added America’s debt is equal to the combined GDP of five other countries: China, Japan, Germany, India, and the United Kingdom. Japan, in particular, is now the U.S.’s top foreign lender, holding about $1.1 trillion in debt as of last October.

“I think that’s an embarrassment,” Penland said. “How can you be the superpower in 1945 and go from there to borrowing money from the country that you bombed with an atomic bomb?”

Political science students from New York’s Siena University studying the presidential primary process in New Hampshire were in the audience. The panelists directed many of their comments to them, noting today’s unfunded spending would be their problem in the future. In particular, they told the students not to believe politicians who say the debt problem can be solved without spending restraint. Growth alone, they all agreed, won’t be enough.

“Unfortunately, America is not top 25 in the world of math, and Washington is not top 100 in the world of math,” Walker said. “Anybody who tells you we can ‘grow’ our way out of this problem at the federal level would flunk math. It doesn’t come close to working.”

Bradley said everyone in Washington knows controlling the growth of entitlement spending — Medicaid, Medicare, and Social Security — is absolutely vital to getting America out of its current borrow-and-spend doom loop. The problem, he said, is politics, and he used G.O.P. presidential candidate Nikki Haley as an example.

“Just look at the Republican presidential primary where the only candidate who’s talking about raising the retirement age [Haley] is being panned by [former] President Trump and Gov. Ron DeSantis,” Bradley said. “I served with [former Rep.] Paul Ryan, the budget guru, and I’m sure a lot of you remember the ads of granny going off the cliff in a wheelchair. Anyone who touches this third rail, it’s problematic.”

But, Bradley added, the issue has to be addressed in a balanced, bipartisan matter. “It’s going to take a lot of compromise. It can’t just be changes to entitlements.”

One question for the panelists was whether, if Congress and the White House did come together with a compromise plan of action to bring down the debt, the average American would trust them. Penland, who has been part of a grassroots effort to address the debt, said no. Most Americans, he said, don’t believe Washington wants to do the right thing for them or that it has the courage to do so.

Each panelist nodded in agreement.

“We’re completely off the chart,” Penland said. “They (politicians) say they don’t want to touch the third rail? Well, we’re off the railroad.”