U.S. Rep. Chris Pappas says the Biden’ Build Back Better” plan he voted for last Friday “is fully paid for and will reduce the deficit by $112 billion.”

Rep. Annie Kuster also says the bill “is fully paid for” by “making super-wealthy corporations and the top one percent pay their fair share.”

But nearly every economic review of the legislation, including the Congressional Budget Office analysis they both claim to rely on, says the bill will add billions in new debt. And the nonpartisan Committee for a Responsible Federal Budget (CRFB) projects the actual cost of the bill is closer to $5 trillion.

That is just one aspect of the budget reconciliation bill Kuster and Pappas helped pass in a straight partisan vote (Maine’s Rep. Jared Golden was the only Democratic “no” vote) that has received little attention from New Hampshire’s media. Democrats say the Child Tax Credit monthly checks, increased healthcare subsidies, and taxpayer-funded pre-K for all will be popular with voters. And they may be right. But there are other details almost certain to appear in campaign ads next year.

ADDING TO THE DEBT

New Hampshire’s congressional delegation touted their votes when the House bill passed last week, even as the Congressional Budget Office released a report indicating the $1.75 trillion social spending bill could increase the deficit between $160 and $360 billion over ten years, despite Biden administration promises the spending will be covered by increased taxes.

And the CRFB points out the Democrats’ plan includes ten years of revenue, but only includes spending on some of the largest items for five years — or even one. For example, the Child Tax Credit sending monthly checks to couples earning up to $150,000 costs $130 billion. But Democrats only include it in their 10-year plan for just one year. Assuming the checks don’t stop in 2024 — an election year– and instead last for the entire 1o years, the actual cost is an additional $1 trillion. None of which is paid for in the current plan.

BENEFITS FOR ILLEGAL IMMIGRANTS

Under the Trump administration, recipients of the monthly Child Tax Credit checks ($300 per child under age six and $250 for each child ages six to 17) had to have Social Security numbers. Under the Build Back Better bill passed by Kuster and Pappas, that requirement is gone, allowing many more people in the U.S. illegally to collect the taxpayer-funded benefit.

The bill also includes a 10-year “amnesty-lite” program in the form of work permits, Social Security numbers, eligibility for welfare benefits, and the ability to get a driver’s license for some 4 or 6 million illegal immigrants. The Washington Post calls it “the largest mass-legalization program for undocumented immigrants in U.S. history.”

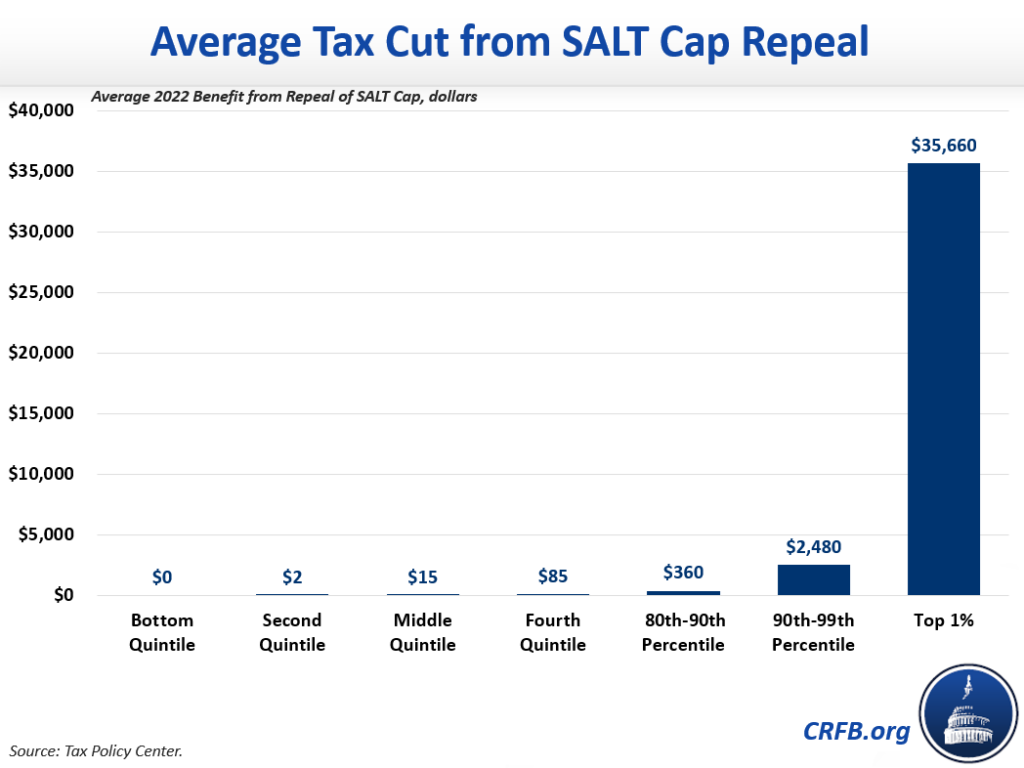

TAX CUTS FOR THE WEALTHY

The Biden budget lifts the cap on state and local tax (SALT) deductions for federal filers from $10,000 to $80,000. Few Americans — and very few Granite Staters — pay $80,000 in state and local taxes. According to the left-leaning Tax Policy Center, the top 20 percent of earners would reap more than 96 percent of the benefits of a SALT repeal, and the top one percent of all earners would see 57 percent of benefits.

Lifting the SALT deduction cap helps subsidize the costs of high local taxes in places like Massachusetts, New York and California. But it does little for the taxpayers of the Granite State. The roughly 10 percent of folks in New Hampshire who itemize deductions only receive about 0.4 percent of the total SALT deduction benefits.

MASSIVE INCREASE IN THE SIZE OF THE IRS

Public pressure killed the Biden administration’s plans to increase bank reporting requirements to reach more lower-income earners — a plan supported early on by both Kuster and Pappas. However, House Democrats did vote to drastically increase the size of the IRS in hopes of collecting more tax revenues.

Democrats voted to add $88 billion of new funding for the IRS, including $45 billion dedicated to enforcement and $4 billion to administer green energy initiatives. The biggest expense will be some 80,000 new IRS agents to conduct audits. The revenue target set by the legislation is $400 billion in additional tax collections over ten years. Given that high-income earners tend to have tax attorneys handling their finances, many observers believe this $40 billion a year will come from small business owners and upper-middle-class individuals.

Democrats dismiss this data, arguing the benefits of the bill outweigh any problems.

“This legislation will lower taxes while bringing down the cost of the everyday expenses that burden so many Granite Staters,” Pappas said. “It will invest in a strong workforce that will help our small businesses and economy thrive. It will lift up working people, give our kids the best head start we can, and chart a course for a healthier, stronger, more resilient future.”