It took more than a little snow to stop a group of small-government advocates from rolling into Great North Aleworks Tuesday night to talk tax cuts, state revenue, and the 2024 legislative session. The message of the event, hosted by the New Hampshire chapter of Americans For Prosperity, was simple.

The follow-up to the state’s recent tax cuts should be more tax cuts.

The two panelists, state Reps. Jordan Ulery (R- Hudson) and Joe Sweeney (R-Salem) recapped the successes Republicans have had in Concord rolling back tax rates: cutting the Business Profits Tax (BPT) and Business Enterprise Tax (BET), phasing out the tax on interest and dividends income (I&D), and providing property tax relief to local communities.

Now, they’re proposing another round of tax cuts.

Sweeney, who serves on the House Finance Committee, has teamed up with House Majority Leader Rep. Jason Osborne to propose cutting the BPT and BET, as well as cutting the Meals and Rooms Tax, and phasing out the Communications Services Tax by 2027.

Sweeney said eliminating the Communications Services Tax — essentially a tax on cellular phone service — shouldn’t be a heavy lift for New Hampshire as revenues continue to outpace the budget.

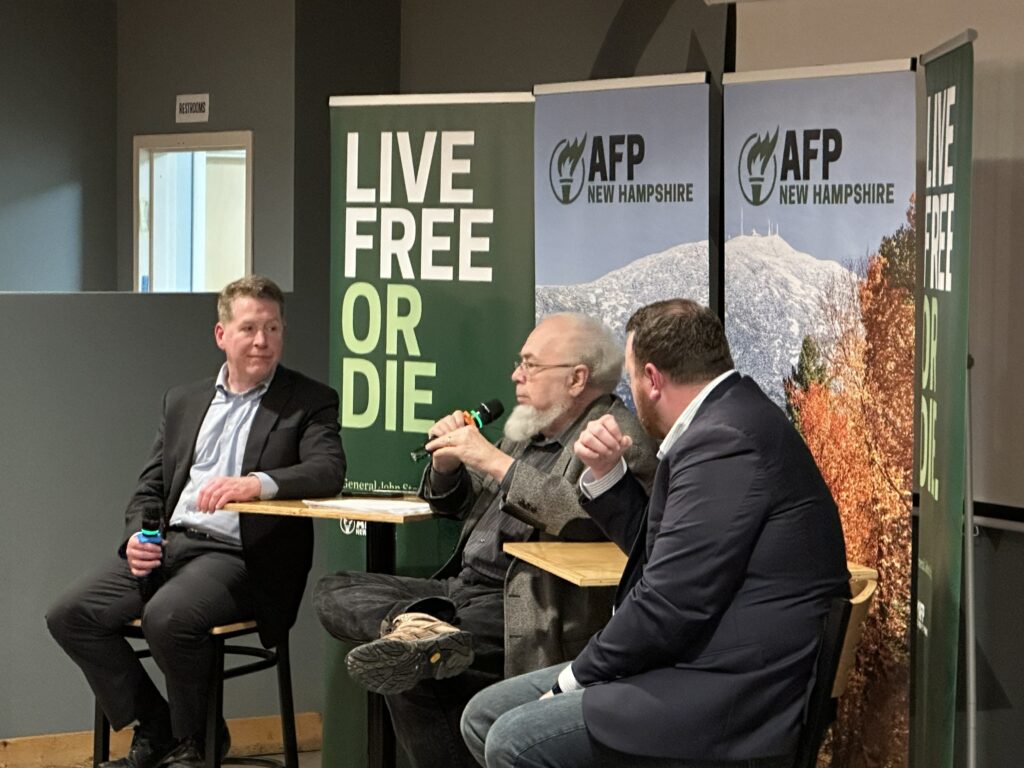

Greg Moore of AFP-NH moderates a panel on tax policy with Rep. Jordan Ulery (R-Hudson) and Rep. Joe Sweeney (R-Salem) at Great North Aleworks in Manchester, N.H.

“The Communication Service Tax is kind of like the weird stepchild of New Hampshire taxes,” Sweeney said. “It’s gradually going down on its own, diminishing in terms, not of the percentage, but the revenue that it brings in.

“Ten years ago, the tax was bringing in about $32 million. This past fiscal year, which should have been higher because it’s been 10 years of inflation, it only brought in around $29 million. So the tax revenues are going down whether we cut it or not.”

And, Ulery added, it’s a reminder of how hard it is for a tax to die.

“Remember, the first communication tax was put in place on the federal level to tax the rich to pay for the Spanish-American War. And it was only eliminated about 10 years ago.” (It was actually eliminated in 2006.)

For Beth Scaer of Nashua, the discussion of the Granite State’s communications tax was particularly timely.

“I had just been looking at my telephone bill, wondering about all the taxes on there, so that part of the conversation was very enlightening.”

As the crowd enjoyed their quesadillas and craft beers, a series issue loomed large over the conversation: the recent ruling by Rockingham Superior Court Judge David Ruoff declaring the state must pay a per-pupil minimum state adequacy grant of $7,356. The net cost to state taxpayers would be nearly $538 million per year – or more.

Democrats have already begun lobbying to roll back the planned phase-out of the I&D income tax. And, some House Democrats argue, any additional tax cut plans should be set aside until the education funding issue is resolved.

“This has been one judge’s ruling. There have been numerous flaws that have been identified in his conclusion,” said AFP-NH state director Greg Moore, who moderated the event. He said he believes the state Supreme Court will step in and overturn the decision.

“We believe the state Supreme Court will realize this is an overreach and perhaps even go back and review the original Claremont ruling.”

Attendees asked questions ranging from fundamental issues of the limits of the state’s right to tax to whether an additional 0.1 percent cut in the BPT or BET really matters.

“I think the less we can tax people, the better,” Sweeney said. “And reducing those taxes by 0.1 percent a year for five years, that’s going to save taxpayers $1.6 billion over seven years.”

Weare Town Moderator John Morton said he found the conversation compelling.

“Overall, we are considered the freest state in the country, but the burden of taxes impinges on our freedoms,” Morton said after the conversation. “The old saying is ‘taxation is theft,’ and sure, there are reasons for taxes. Things have to be paid for.

“But they can also be used in a punitive way, a way that impinges on our prosperity.”