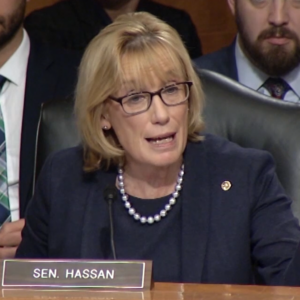

Progressive plans for a massive $3.5 trillion spending bill appear to be heading for a collision with President Joe Biden’s pledge not to raise taxes on America’s middle class. It’s a conflict that could put New Hampshire’s D.C. delegation in the political crosshairs, in particular Sen. Maggie Hassan, who sits on both the Senate Finance Committee and the Health, Education, Labor and Pension Committee.

Speaker Nancy Pelosi has made it clear she believes Democrats should couple the bipartisan $1.2 trillion infrastructure deal negotiated in the U.S. Senate to the broader social spending in the proposal developed by Senate Budget Committee Chairman Sen. Bernie Sanders (I-Vt.). But finding “pay-fors” for a single spending bill that’s nearly as large as the entire federal budget was just five years ago is difficult.

Seeing his opportunity, Sen. Dick Durbin (D-Ill.) wants to throw his “Tobacco Tax Equity Act” into the mix. It would double the federal tax on cigarettes from $1 to $2 per pack, and then raise taxes on non-cigarette products like cigars, pipe tobacco, and e-cigarettes by an equivalent amount.

Doubling tobacco taxes would appear to violate Biden’s pledge not to raise taxes on households earning $400,000 or less.

A lot less.

According to the anti-smoking organization Truth Initiative, 72 percent of smokers live in lower-income communities. A 2016 study found 29 percent of adults living below the poverty line were smokers, as opposed to just 16 percent among those above it.

This massive tax hike would hit the working class hard. Ulrick Boesen of the Tax Foundation gives a concrete example. “If you make $15,000 a year and you live in New York, you’re paying 16.6 percent of your income in tobacco taxes to smoke a pack of cigarettes a day. Almost 17 percent of your income goes to tobacco taxes.”

That price pressure is one reason illicit cigarette sales are thriving in New York, where more than half of all cigarettes are “smuggled,” that is they’ve crossed the state line without being taxed locally.

And the state with the highest rate of outbound “smuggled” cigarettes is New Hampshire, Boesen notes. “New Hampshire has the highest level of outbound smuggling at 66.8 percent of consumption, not because its taxes are so low, but because it’s surrounded by states whose taxes are so high.” The state would lose an estimated $13.5 million in tobacco tax revenue, based on industry estimates.

This bill would drive down revenue for convenience stores as well. Nearly 89 percent of all tobacco sales occur in convenience stores. And according to a study by Management Science Associates, Inc., for every $8.33 in cigarettes purchased, buyers purchase on average $6.87 in non-tobacco products.

And then there’s New Hampshire’s thriving cigar bar industry, which Joshua Habursky of the Premium Cigar Association says will be directly endangered by this tax hike.

“New Hampshire has an organic cigar bar culture that’s a model to other states. They see the jobs created, the revenue from these locally-owned small businesses and they’re re-thinking their regulation. We’re seeing it in places like Augusta, Ga., and Louisville, Ky.”

The size of the tax increase on these products is difficult to predict because it changes the federal tax on premium cigars from a percentage of the import price to a weight-based system. According to one industry analysis, in a state like New Hampshire would raise the price of a typical cigar by more than 26 percent.

“A law like this will raise revenue the first year, but then businesses will shut down because it’s not viable,” Habursky said. “Particularly the smaller, independent shops.”

Anti-tobacco activists argue putting retailers out of business isn’t necessarily a bad thing if the result is fewer smokers. One in five deaths in the U.S. each year is linked to cigarette smoking.

But the available evidence shows price hikes and bans don’t stop smokers from smoking, it just changes their buying habits. And this, opponents of Durbin’s bill say, is the most dangerous aspect.

Currently, alternatives to traditional cigarettes like e-cigarettes are taxed at a lower rate – if they’re taxed at all. And while these products aren’t risk free, the FDA and other public health organizations have acknowledged they are far less harmful than combustible cigarettes. Affordable alternatives make it easier for smokers to set down the pack and pick up an e-cig pod.

This tax hike would drive those prices straight up.

“That’s where the equity part of the title comes in,” Boesen says. “The question is whether it’s better public policy to just tax tobacco as much as you can, or is it better to encourage current smokers to find less harmful products? One of the ways you do that is by taxing less harmful products at lower rates than cigarettes.”

The FDA has granted “Modified Risk Tobacco Product” authorizations to a dozen products, including smokeless tobacco and the IQOS “heat not burn” system, finding they present far lower health risks than traditional cigarettes. Taxing them at the same rate as cigarettes may be “equity,” but public health advocates say the risks aren’t equal, therefore the tax treatment shouldn’t be, either.

“This tax increase violates Biden’s pledge against any tax on any American making less than $400,000. Biden made this pledge at least 50 times,” says Tim Andrews of Americans for Tax Reform. “This tax will also cost lives. Modeling has shown that imposing a federal tax on e-cigarettes, which are 95 percent safer than smoking, will deter 2.75 million smokers from quitting – with tragic effect. Small increases in projected revenue should never come at the expense of human lives.”

If this tax hike becomes law, it will almost certainly be as part of a budget reconciliation deal that will require every Democratic senator’s support. If either Sens. Maggie Hassan or Jeanne Shaheen say ‘no,’ this tax plan won’t pass.

Granite State taxpayers, retailers and public health advocates will be watching closely.