For years, proponents of a state income tax have accused state lawmakers of “downshifting costs” to local school districts, asserting that the legislature is failing to adequately fund our public schools. Similar statements are often echoed at the local level, particularly when districts need a convenient scapegoat in the face of tough spending decisions. 2026 will be no different. Be prepared to see “downshifting costs” as a campaign slogan statewide.

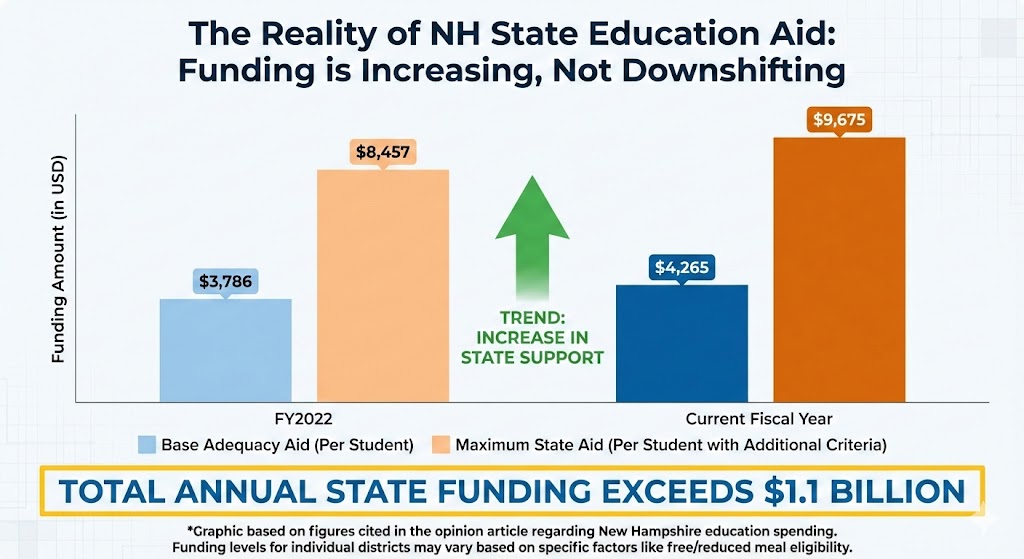

Unfortunately for the pro-income-tax crowd, the facts simply don’t support that narrative. Far from cutting aid, the legislature has maintained and even increased support for K-12 education, with total state funding exceeding $1.1 billion annually. It’s time to set the record straight.

Consider recent communications from the Rochester School District, where official notices and meeting minutes repeatedly referenced “a reduction in adequacy funding from the State.” That language is grossly misleading. In fact, state adequacy aid has steadily increased each year, from a base of $3,786 in fiscal year 2022 to $4,265 in the current fiscal year. For students who meet additional criteria, maximum state aid has risen from $8,457 to $9,675 over the same period.

So why were Rochester school officials saying that state aid has been reduced? Because former administrators at the district made a clerical reporting error, understating the number of Rochester students eligible for free and reduced meals. School districts get additional aid for each student who qualifies for that program, so when the numbers came in lower than in previous years, state officials adjusted the district’s funding according to the aid formula. That resulted in a lower amount going to Rochester, but it wasn’t because of a state decision to reduce aid; it happened because the district’s former administrators submitted the wrong numbers.

Fortunately, the state will allow Rochester’s school officials to submit corrected figures, so the district will eventually receive full funding based on the higher figures. But that isn’t likely to happen until after tax rates are set, so that Rochester taxpayers will see a short-term spike in their property tax bills. For many, however, the insinuation remains; people are left with the impression that the state has cut funding, when in fact state aid has actually increased.

The budgetary mismanagement in Claremont tells a much darker story. Claremont receives more than $12,000 per student from the state, far more than the state’s base adequacy aid of $4,265. Nevertheless, academic results in Claremont rank among the lowest statewide. Despite this substantial support, the district has a multimillion-dollar deficit. Gross mismanagement has left Claremont with massive liabilities and virtually no cash reserves. To make matters worse, the district missed out on substantial federal funding simply because local administrators failed to submit the required paperwork. The offending school officials are gone, but Claremont families, students, and taxpayers are left to deal with the mess they left behind.

These examples reflect a broader reality in New Hampshire education funding. Granite Staters value local control, yet we rarely talk about local responsibility. School boards and administrators must take ownership of their spending decisions and financial management. Scapegoating the state simply distracts from the need for accountability where it matters most: in local administrative offices and on school boards.

As the legislature considers measures to ensure continuity in the Claremont schools, we have an opportunity to step up accountability for school boards and administrators. In doing so, we stand to protect students and taxpayers from the fallout caused by gross negligence and incompetence at the local level.

New Hampshire’s legislature remains committed to strong public schools, but sustainable progress requires partnership, not finger-pointing. Let’s focus on improving transparency, shoring up accountability, and ensuring that every dollar is spent wisely. Our kids deserve better than myths and mismanagement.