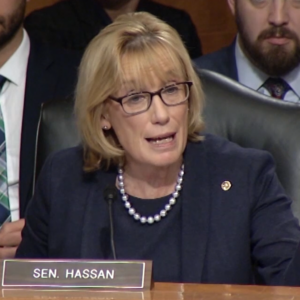

If Sen. Maggie Hassan votes for the Democrats’ reconciliation bill, she will stick New Hampshire companies with a higher tax rate than communist China.

The Democrats’ reconciliation bill would leave New Hampshire with a combined federal-state corporate tax rate of 32.2 percent vs. communist China’s 25 percent.

The Democrat bill will also put New Hampshire companies at a competitive disadvantage vs. Europe: The European average corporate tax rate is 19 percent.

“As the country tries to recover from a once-in-a-century pandemic, Hassan must explain why she wants to stick New Hampshire companies with higher taxes than China and Europe,” said Grover Norquist, president of Americans for Tax Reform.

The Democrats’ $3.5 trillion bill will impose the largest tax increase since 1968. It will raise individual income taxes, small business taxes, corporate taxes, and capital gains taxes. If passed, the combined federal-state capital gains tax rate for New Hampshire companies would be 36.8 percent vs. China’s 20 percent.

The burden of the corporate tax rate hike will be borne by workers in the form of lower wages, and by households in the form of higher prices. Higher corporate tax rates will also raise utility bills.

The non-partisan Joint Committee on Taxation recently affirmed in congressional testimony that the corporate tax rate hike will fall on “labor, laborers.”

Testifying before the House Ways & Means Committee, JCT Chief of Staff Thomas A. Barthold said:

“Literature suggests that 25 percent of the burden of the corporate tax may be borne by labor in terms of diminished wage growth.

Economists across the political spectrum agree that workers bear the brunt of corporate tax increases. And 25 percent is on the very low end.

According to the Stephen Entin of the Tax Foundation, labor (or workers) bear an estimated 70 percent of the corporate income tax:

“Over the last few decades, economists have used empirical studies to estimate the degree to which the corporate tax falls on labor and capital, in part by noting an inverse correlation between corporate taxes and wages and employment. These studies appear to show that labor bears between 50 percent and 100 percent of the burden of the corporate income tax, with 70 percent or higher the most likely outcome.”

A 2012 paper at the University of Warwick and University of Oxford found that a $1 increase in the corporate tax reduces wages by 92 cents in the long term. This study was conducted by Wiji Arulampalam, Michael P. Devereux, and Giorgia Maffini and studied over 55,000 businesses located in nine European countries over the period 1996-2003:

“We identify this direct shifting through cross-company variation in tax liabilities, conditional on value added per employee. Our central estimate is that $1 of additional tax reduces wages by 92 cents in the long run. The incidence of a $1 fall in value added is smaller, consistent with our wage bargaining model.”

A 2015 study by Kevin Hassett and Aparna Mathur found that a 1 percent increase in corporate tax rates leads to a 0.5 percent decrease in wage rates. The study analyses 66 countries over 25 years and concludes that workers could see a greater reduction in wages than the federal government raises in new revenue from a corporate income tax increase:

“We find, controlling for other macroeconomic variables, that wages are significantly responsive to corporate taxation. Higher corporate tax rates depress wages. Using spatial modeling techniques, we also find that tax characteristics of neighbouring countries, whether geographic or economic, have a significant effect on domestic wages.”

A 2006 study by William Randolph of the Congressional Budget Office found that 74% of the corporate tax is borne by domestic labor:

“Burdens are measured in a numerical example by substituting factor shares and output shares that are reasonable for the U.S. economy. Given those values, domestic labor bears slightly more than 70 percent of the burden of the corporate income tax.”

A 2007 study by Alison Felix estimated that a 1 percentage point increase in the marginal corporate tax rate decreases annual wages by 0.7 percent. She concluded that the wage reductions are over four times the amount of collected corporate tax revenue:

“The empirical results presented here suggest that the incidence of corporate taxation is more than fully borne by labor. I estimate that a one percentage point increase in the marginal corporate tax rate decreases annual wages by 0.7 percent. The magnitude of the results predicts that the decrease in wages is more than four times the amount of the corporate tax revenue collected.”

A 2012 Harvard Business Review piece by Mihir A. Desai notes that raising the corporate tax lands “straight on the back” of the American worker and will see a decline in real wages:

“Because capital is mobile, high tax rates divert investment away from the U.S. corporate sector and toward housing, noncorporate business sectors, and foreign countries. American workers need that capital to become more productive. When it’s invested elsewhere, real wages decline, and if product prices are set globally, there is no place for the corporate tax to land but straight on the back of the least-mobile factor in this setting: the American worker.”

Even the left-of-center Tax Policy Center estimates that 20 percent of the burden of the corporate income tax is borne by labor:

“In calculating distributional effects, the Urban-Brookings Tax Policy Center (TPC) assumes investment returns (dividends, interest, capital gains, etc.) bear 80 percent of the burden, with wages and other labor income carrying the remaining 20 percent.”

“Hassan would be wise to oppose any tax increase,” said Norquist.